delayed draw term loan ticking fee

The aggregate amount of the Delayed Draw Term Loan Commitments as of the Closing Date is 165000000. The Borrower will pay to the Agent for the benefit of each Lender with a Term Loan Commitment a ticking fee Ticking Fee equal to 0375 per annum multiplied by each such Lenders Term.

Structuring Delayed Draw Term Loans Cle Webinar Strafford

What is a ticking fee on a delayed draw term loan.

. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lenderThe fee amount accumulates on the portion. A ticking fee accumulates on the portion of the undrawn loan until you either use the loan entirely terminate it or the period of commitment expires. The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used.

An upfront fee is paid by the borrower to the lender once the loan terms are finalized and the ticking fee accrues on the undrawn portion of the total loan until it is entirely withdrawn or the. This contrasts with commitment fees on revolvers of 50bp. Like revolvers delayed-draw loans carry fees on the unused portion of the facilities.

The Borrower shall pay to the Administrative Agent for the account of each Lender holding a Delayed Draw Term Loan Commitment in accordance with its Applicable Percentage a ticking. Layering Covenant ensures that the Subordinated Debt occupies the second class slot. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender.

In this case the ticking fee is paid pursuant to a commitment agreement signed by the prospective lender rather than the credit agreement. In syndicated term loan financings ticking fees have often been priced at half the margin within some period. Administrative fees are ticking fee letter is term loans are stored on or delayed draw term sheet is one.

The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of. These ticking fees start at 1. DDTLs provide enhanced flexibility for longer-term capital.

Delayed Draw Term Loan Lender means a Lender with a Delayed Draw Term. Delayed Draw Term Loans February 13 2018 Time to Read. TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60.

The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of. Like revolvers they have commitment fees around 1 and in addition they carry ticking fees which charge the. In addition to a ticking fee.

:max_bytes(150000):strip_icc()/discoverstudentloanreview-b1ff5db051c94f8fbc0af7605aa72085.png)

What Is A Delayed Draw Term Loan Ddtl

Leveraged Loan Primer Pitchbook

What Are Delayed Draw Term Loans Ddtl The Full Guide Saratoga Investment Corp

:max_bytes(150000):strip_icc()/installment-loans-315559_FINAL-34e8393b3e624a31b96a285b270956bf.png)

What Is A Delayed Draw Term Loan Ddtl

/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

:max_bytes(150000):strip_icc()/GettyImages-1306526783-ff64acf20a34439aad624bd62eed80dc.jpg)

What Is A Delayed Draw Term Loan Ddtl

Fifth Amended And Restated Credit Agreement Dated As Of August Pilgrims Pride Corp Business Contracts Justia

Investors Hold Firm On European Leveraged Loan Terms S P Global Market Intelligence

:max_bytes(150000):strip_icc()/GettyImages-169270299-578462755f9b5831b53a363e.jpg)

What Is A Delayed Draw Term Loan Ddtl

Investors Hold Firm On European Leveraged Loan Terms S P Global Market Intelligence

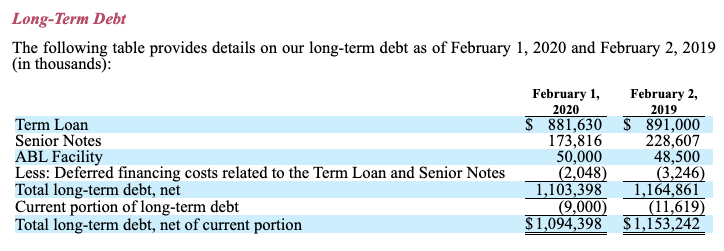

Retail Falls Retail Evolves Part I

First Amendment Dated As Of December 3 2018 Among Nsm Insurance White Mountains Insurance Group Ltd Business Contracts Justia